New setting for Dutch VAT adjustment from 9% to 21% for arrivals in 2026 Update Reservation software 3 April 2025

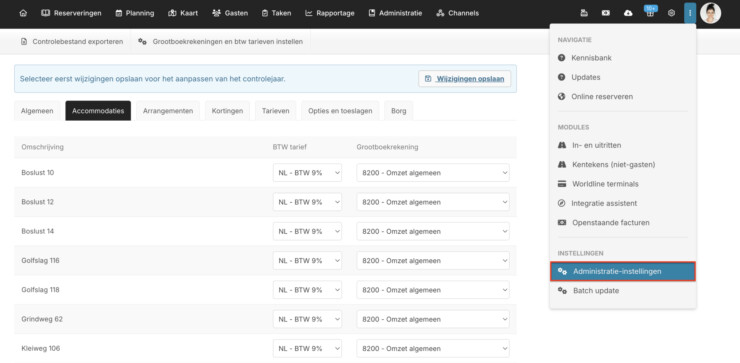

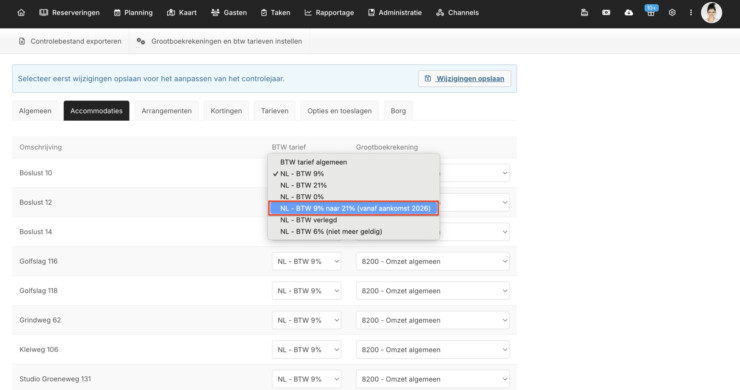

In view of the (almost final) adjustment of VAT on accommodation as of January 1, 2026 in the Netherlands, we have added a setting in our reservation system. With this setting you can set the VAT for all accommodations to ‘VAT 9% to 21% (as of arrival 2026)’. When you set this VAT rate for all properties, the system will ensure that all arrivals in 2025 will be charged at 9% VAT and all arrivals from January 2026 will be charged at 21% VAT. You can easily set this via the vertical dotted line at the top right of your screen, choose ‘Administration settings’, so that you immediately get an overview of all set ledgers and VAT percentages. From here the new VAT setting can be activated for all accommodations.

Do you have a question about this setting? Feel free to contact us at email hidden; JavaScript is required.Read more about our reservation system!

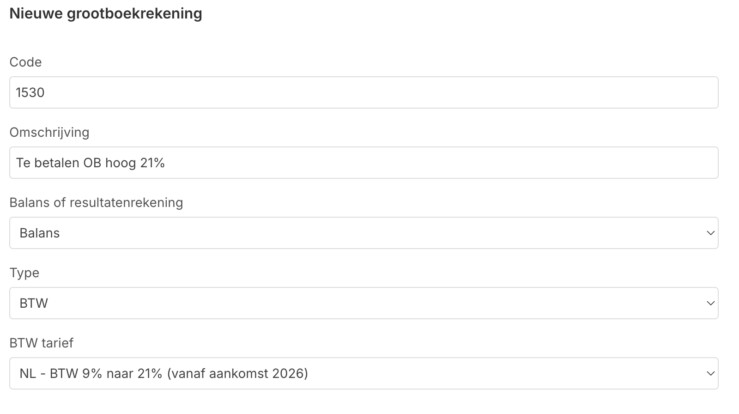

To properly process the transition to 21% VAT in 2026 in your administration, it is important to create a separate general ledger account for this.

- Go to Administration > Accounting > General ledger accounts

- Click on New general ledger account in the top right corner

- Fill in the following fields:

Code: a number of your choice, for example 1530

Description: VAT payable high 21%

Balance sheet or income statement: Balance sheet

Type: VAT

VAT rate: NL – VAT 9% to 21% (from 2026)

All VAT amounts at 21% applicable from 2026 will be automatically posted to this account. This provides a clear overview of which portion relates to the transition period. If, during Prinsjesdag, it is decided not to implement the VAT increase, this will be clearly shown separately in your general ledger account.

Do you have a question about this setting? Feel free to contact us at email hidden; JavaScript is required.

Read more about our reservation system!